What Happened to My Portfolio? What Next?

September 28, 2022

We hope that this article finds you and your team having a great and healthy start to the 2022 season. It sure is nice to have football back- and back in what seems to be a normal manner.

The term “normal” inevitably means something different to every coach (or investor) out there. From win-loss records to depth charts to players’ executing early season playbooks to managing injuries and everything in between, you all have built-in expectations of what is “normal”. Similarly, in regards to your investment portfolios, 401(k) and 403(b) plans, IRAs, etc., you likely also have built-in expectations of the financial and investment planning aspects of life too.

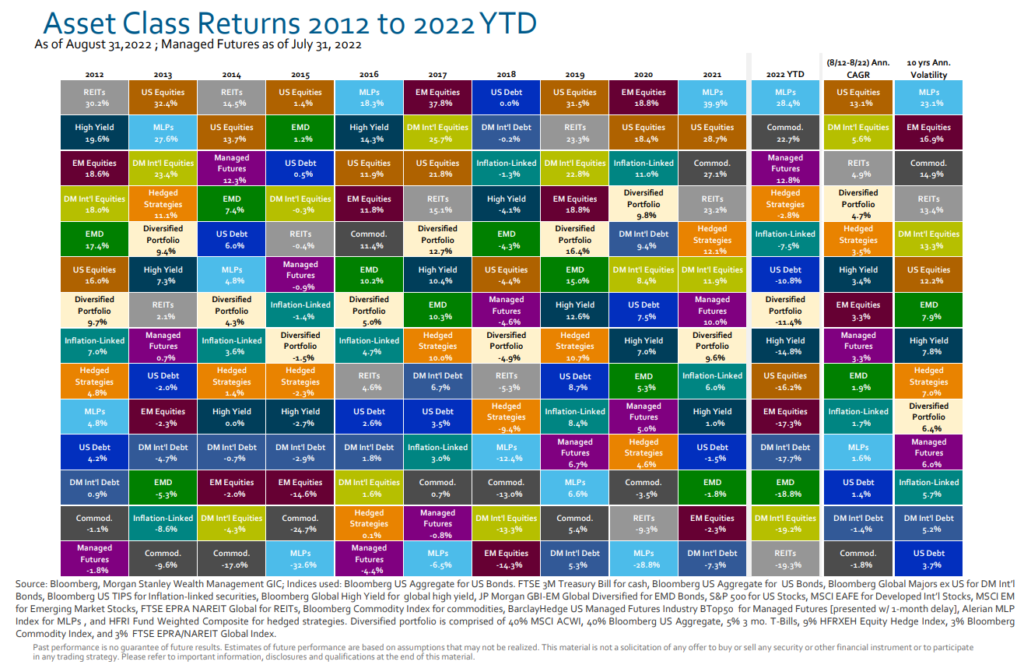

Unfortunately, for most investors across all career paths, 2022 has been anything but “normal”. Through August 31, U.S. Equities as measured by the S&P 500 index were down 16.2% year-to-date. Popular sectors such as Consumer Discretionary and Information Technology were down 23.8% and 22.1%, respectively. Similarly, Developed International Stocks were down 19.2% while Emerging Markets Stocks were down 17.3%. As you can see, there have been very few places to find a positive return in the global stock market in 2022.

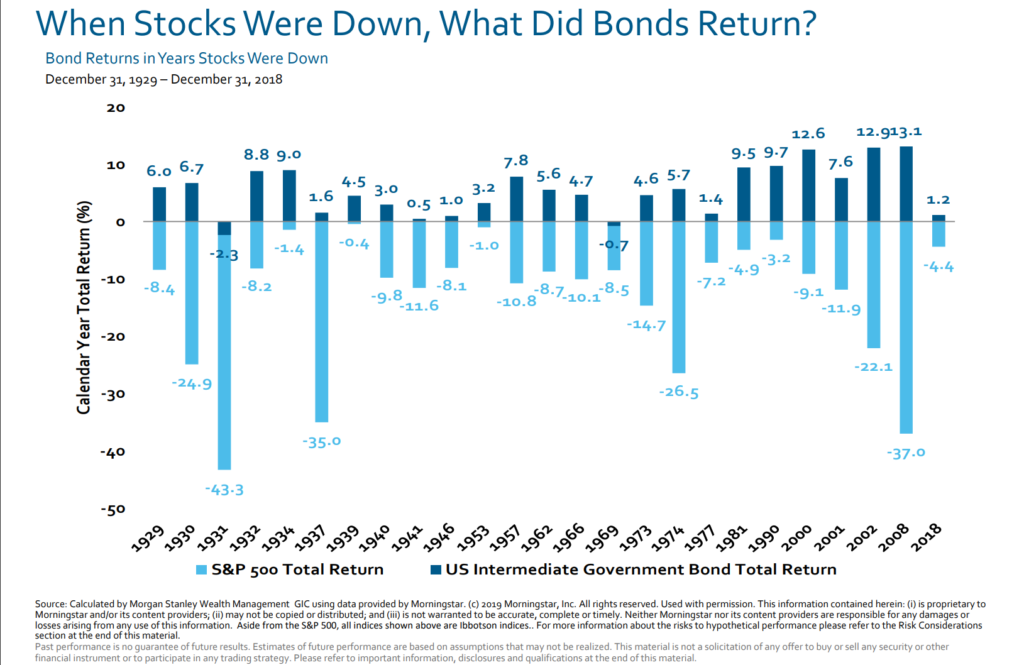

While volatility in the stock market can be considered normal and should be expected from time to time, most investors have historically found a “safe haven” in the bond market. This is where 2022 has gone off the rails. With the yield on the 10-Year Treasury Bond going from 1.31% to 3.19% over the last twelve months, the total return on the U.S. Aggregate Bond Market index was down 10.8% year-to-date through August 31. That, coaches, is far from normal no matter how you slice it.

The chart below includes years when the S&P 500 index was down since 1926. The chart also shows the return on the aggregate bond market during those same years. Only twice out of 25 years of a negative stock market (looking back almost 100 years) did the bond market NOT provide the benefit of a positive return and add value for diversified investors. Unfortunately, unless either the stock or the bond market reverses course over the next four months and achieves a positive return for 2022, this year will mark only the third year ever that both the stock market and the bond market give investors a negative return. Far from “normal”.

So, what to do next? Instead of making typical investor mistakes that may hurt you in the long-haul, here are some tips for this phase of the market cycle:

- Do NOT panic sell.

Instead, consider this: Take the long view. If you don’t need cash right away and have a well-researched, diversified portfolio, realize that downturns ultimately are temporary. The market may sometimes feel like it could go to zero, but market history shows that rebounds can return many portfolios to the black in just a few years.

- Do NOT go to cash and stay there.

Instead, consider this: Investors who have more cash than their long-term strategy calls for because they sold during the market slide, or for any other reason, should look to close that gap and get invested. Dollar-cost averaging, a method where you buy set amounts of stock at regular intervals (say, monthly) to get back into the market gradually, can be a good way to get there. Dollar-cost averaging may help to reduce the sensitivity of your portfolio to the luck of timing, which can make it easier for fearful investors to move out of cash, since they can avoid the worry of putting a big chunk of money into the market, only to have the sell-off resume. And if the market rebounds, they will be glad that they already put some of their money back to work, rather than having all of it on the sidelines.

- Do NOT dig a deeper hole trying to make up for losses or bad choices.

Instead, consider this: Proactively take advantage of current opportunities, which can often run counter to those instincts. For example, if losses arise in a taxable investment account, “harvesting” them by selling those positions may improve long-term tax efficiency when appropriate. Also, many investors may be better off converting at least some of their retirement savings from a traditional IRA to a Roth IRA. Since there are tax consequences, doing a conversion when stock values are depressed may be a good move. This, again is something a Financial Advisor can help with.

- Do NOT forget to rebalance.

Instead, consider this: If you’ve decided on a rebalancing plan, stick to it. Studies have shown that rebalancing tends to improve risk-adjusted returns over time, as long as it doesn’t generate excessive tax and transaction costs, by reducing portfolio sensitivity to the timing of up and down markets. It also gels with markets’ natural tendency to revert to the mean.

In times of market uncertainty, you don’t have to figure out what to do next on your own. Find a Financial Advisor you trust to go through your portfolio with you and help you understand how best to proceed, based on your time horizon and risk tolerance. If you do not have a Financial Advisor of your own, we are happy to help you and your families be as prepared as possible for the financial planning side of your unique and demanding lifestyle. Please do not hesitate to contact us at [email protected] or directly at (502) 394-4094. We are happy to help you like we have helped and continue to help other coaches and families in similar situations.

Keith Norris

Matt Kuerzi

About the Authors

Keith Norris, First Vice President and Financial Advisor, and Matt Kuerzi, Vice President and Financial Advisor, are co-founders of The Derby City Group at Morgan Stanley in Louisville, Kentucky. They have combined over 40 years of experience helping families with their financial planning (1). In 2019, Matt was recognized by Forbes in their first ever list of “Best-In-State Next-Gen Advisors”. He can be reached directly at (502) 394-4094 or [email protected].

Branch address: 4969 U.S. Highway 42, Suite 1200, Louisville, KY 40222

(1) Keith Norris, First Vice President, Financial Advisor, experienced in the financial services industry since 1997. Matt Kuerzi, Vice President, Financial Advisor, experienced in the financial services industry since 2002.

The information contained in this article is not a solicitation to purchase or sell investments. Any information presented is general in nature and not intended to provide individually tailored investment advice. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. Investing involves risks and there is always the potential of losing money when you invest.

Tax laws are complex and subject to change. Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice and are not “fiduciaries” (under the Investment Advisers Act of 1940, ERISA, the Internal Revenue Code or otherwise) with respect to the services or activities described herein except as otherwise provided in writing by Morgan Stanley and/or as described at www.morganstanley.com/disclosures/dol. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a retirement plan or account, and (b) regarding any potential tax, ERISA and related consequences of any investments made under such plan or account.

Source: Forbes.com (July, 2021). Top Next-Gen Wealth Advisors. SHOOK considered advisors born in 1981 or later with a minimum 4 years as an advisor. Advisors have: built their own practices and lead their teams; joined teams and are viewed as future leadership; or a combination of both. Ranking algorithm is based on qualitative measures: telephone and in-person interviews, client retention, industry experience, credentials, review of compliance records, firm nominations; and quantitative criteria, such as: assets under management and revenue generated for their firms. Investment performance is not a criterion because client objectives and risk tolerances vary, and advisors rarely have audited performance reports. Rankings are based on the opinions of SHOOK Research, LLC, and are not indicative of future performance or representative of any one client’s experience. Neither Morgan Stanley Smith Barney LLC nor its Financial Advisors or Private Wealth Advisors pay a fee to Forbes or SHOOK Research in exchange for the ranking. For more information, see www.SHOOKresearch.com.

Asset Allocation does not assure a profit or protect against loss in declining financial markets.

The views expressed herein are those of the author and do not necessarily reflect the views of Morgan Stanley Wealth Management or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

Morgan Stanley Smith Barney LLC offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please visit us at http://www.morganstanleyindividual.com or consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC. Member SIPC.

CRC 4841404 7/2022

For more information about the AFCA, visit www.AFCA.com. For more interesting articles, check out The Insider and subscribe to our weekly email.

If you are interested in more in-depth articles and videos, please become an AFCA member. You can find out more information about membership and specific member benefits on the AFCA Membership Overview page. If you are ready to join, please fill out the AFCA Membership Application.

« « Previous PostNext Post » »

We hope that this article finds you and your team having a great and healthy start to the 2022 season. It sure is nice to have football back- and back in what seems to be a normal manner.

The term “normal” inevitably means something different to every coach (or investor) out there. From win-loss records to depth charts to players’ executing early season playbooks to managing injuries and everything in between, you all have built-in expectations of what is “normal”. Similarly, in regards to your investment portfolios, 401(k) and 403(b) plans, IRAs, etc., you likely also have built-in expectations of the financial and investment planning aspects of life too.

Unfortunately, for most investors across all career paths, 2022 has been anything but “normal”. Through August 31, U.S. Equities as measured by the S&P 500 index were down 16.2% year-to-date. Popular sectors such as Consumer Discretionary and Information Technology were down 23.8% and 22.1%, respectively. Similarly, Developed International Stocks were down 19.2% while Emerging Markets Stocks were down 17.3%. As you can see, there have been very few places to find a positive return in the global stock market in 2022.

While volatility in the stock market can be considered normal and should be expected from time to time, most investors have historically found a “safe haven” in the bond market. This is where 2022 has gone off the rails. With the yield on the 10-Year Treasury Bond going from 1.31% to 3.19% over the last twelve months, the total return on the U.S. Aggregate Bond Market index was down 10.8% year-to-date through August 31. That, coaches, is far from normal no matter how you slice it.

The chart below includes years when the S&P 500 index was down since 1926. The chart also shows the return on the aggregate bond market during those same years. Only twice out of 25 years of a negative stock market (looking back almost 100 years) did the bond market NOT provide the benefit of a positive return and add value for diversified investors. Unfortunately, unless either the stock or the bond market reverses course over the next four months and achieves a positive return for 2022, this year will mark only the third year ever that both the stock market and the bond market give investors a negative return. Far from “normal”.

So, what to do next? Instead of making typical investor mistakes that may hurt you in the long-haul, here are some tips for this phase of the market cycle:

- Do NOT panic sell.

Instead, consider this: Take the long view. If you don’t need cash right away and have a well-researched, diversified portfolio, realize that downturns ultimately are temporary. The market may sometimes feel like it could go to zero, but market history shows that rebounds can return many portfolios to the black in just a few years.

- Do NOT go to cash and stay there.

Instead, consider this: Investors who have more cash than their long-term strategy calls for because they sold during the market slide, or for any other reason, should look to close that gap and get invested. Dollar-cost averaging, a method where you buy set amounts of stock at regular intervals (say, monthly) to get back into the market gradually, can be a good way to get there. Dollar-cost averaging may help to reduce the sensitivity of your portfolio to the luck of timing, which can make it easier for fearful investors to move out of cash, since they can avoid the worry of putting a big chunk of money into the market, only to have the sell-off resume. And if the market rebounds, they will be glad that they already put some of their money back to work, rather than having all of it on the sidelines.

- Do NOT dig a deeper hole trying to make up for losses or bad choices.

Instead, consider this: Proactively take advantage of current opportunities, which can often run counter to those instincts. For example, if losses arise in a taxable investment account, “harvesting” them by selling those positions may improve long-term tax efficiency when appropriate. Also, many investors may be better off converting at least some of their retirement savings from a traditional IRA to a Roth IRA. Since there are tax consequences, doing a conversion when stock values are depressed may be a good move. This, again is something a Financial Advisor can help with.

- Do NOT forget to rebalance.

Instead, consider this: If you’ve decided on a rebalancing plan, stick to it. Studies have shown that rebalancing tends to improve risk-adjusted returns over time, as long as it doesn’t generate excessive tax and transaction costs, by reducing portfolio sensitivity to the timing of up and down markets. It also gels with markets’ natural tendency to revert to the mean.

In times of market uncertainty, you don’t have to figure out what to do next on your own. Find a Financial Advisor you trust to go through your portfolio with you and help you understand how best to proceed, based on your time horizon and risk tolerance. If you do not have a Financial Advisor of your own, we are happy to help you and your families be as prepared as possible for the financial planning side of your unique and demanding lifestyle. Please do not hesitate to contact us at [email protected] or directly at (502) 394-4094. We are happy to help you like we have helped and continue to help other coaches and families in similar situations.

Keith Norris |

Matt Kuerzi |

About the Authors

Keith Norris, First Vice President and Financial Advisor, and Matt Kuerzi, Vice President and Financial Advisor, are co-founders of The Derby City Group at Morgan Stanley in Louisville, Kentucky. They have combined over 40 years of experience helping families with their financial planning (1). In 2019, Matt was recognized by Forbes in their first ever list of “Best-In-State Next-Gen Advisors”. He can be reached directly at (502) 394-4094 or [email protected].

Branch address: 4969 U.S. Highway 42, Suite 1200, Louisville, KY 40222

(1) Keith Norris, First Vice President, Financial Advisor, experienced in the financial services industry since 1997. Matt Kuerzi, Vice President, Financial Advisor, experienced in the financial services industry since 2002.

The information contained in this article is not a solicitation to purchase or sell investments. Any information presented is general in nature and not intended to provide individually tailored investment advice. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. Investing involves risks and there is always the potential of losing money when you invest.

Tax laws are complex and subject to change. Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice and are not “fiduciaries” (under the Investment Advisers Act of 1940, ERISA, the Internal Revenue Code or otherwise) with respect to the services or activities described herein except as otherwise provided in writing by Morgan Stanley and/or as described at www.morganstanley.com/disclosures/dol. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a retirement plan or account, and (b) regarding any potential tax, ERISA and related consequences of any investments made under such plan or account.

Source: Forbes.com (July, 2021). Top Next-Gen Wealth Advisors. SHOOK considered advisors born in 1981 or later with a minimum 4 years as an advisor. Advisors have: built their own practices and lead their teams; joined teams and are viewed as future leadership; or a combination of both. Ranking algorithm is based on qualitative measures: telephone and in-person interviews, client retention, industry experience, credentials, review of compliance records, firm nominations; and quantitative criteria, such as: assets under management and revenue generated for their firms. Investment performance is not a criterion because client objectives and risk tolerances vary, and advisors rarely have audited performance reports. Rankings are based on the opinions of SHOOK Research, LLC, and are not indicative of future performance or representative of any one client’s experience. Neither Morgan Stanley Smith Barney LLC nor its Financial Advisors or Private Wealth Advisors pay a fee to Forbes or SHOOK Research in exchange for the ranking. For more information, see www.SHOOKresearch.com.

Asset Allocation does not assure a profit or protect against loss in declining financial markets.

The views expressed herein are those of the author and do not necessarily reflect the views of Morgan Stanley Wealth Management or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

Morgan Stanley Smith Barney LLC offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please visit us at http://www.morganstanleyindividual.com or consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC. Member SIPC.

CRC 4841404 7/2022

For more information about the AFCA, visit www.AFCA.com. For more interesting articles, check out The Insider and subscribe to our weekly email.

If you are interested in more in-depth articles and videos, please become an AFCA member. You can find out more information about membership and specific member benefits on the AFCA Membership Overview page. If you are ready to join, please fill out the AFCA Membership Application.